Intermodal & Drayage: An Opportunity to Reduce Freight Emissions

Ships, trains, planes, barges, trucks, even bicycles — odds are your latest package delivery traveled on all of these to get to you. Intermodal is not one mode preferentially used, but an integral system of modes working together to efficiently and reliably transport products from the point of origin to the consumer.

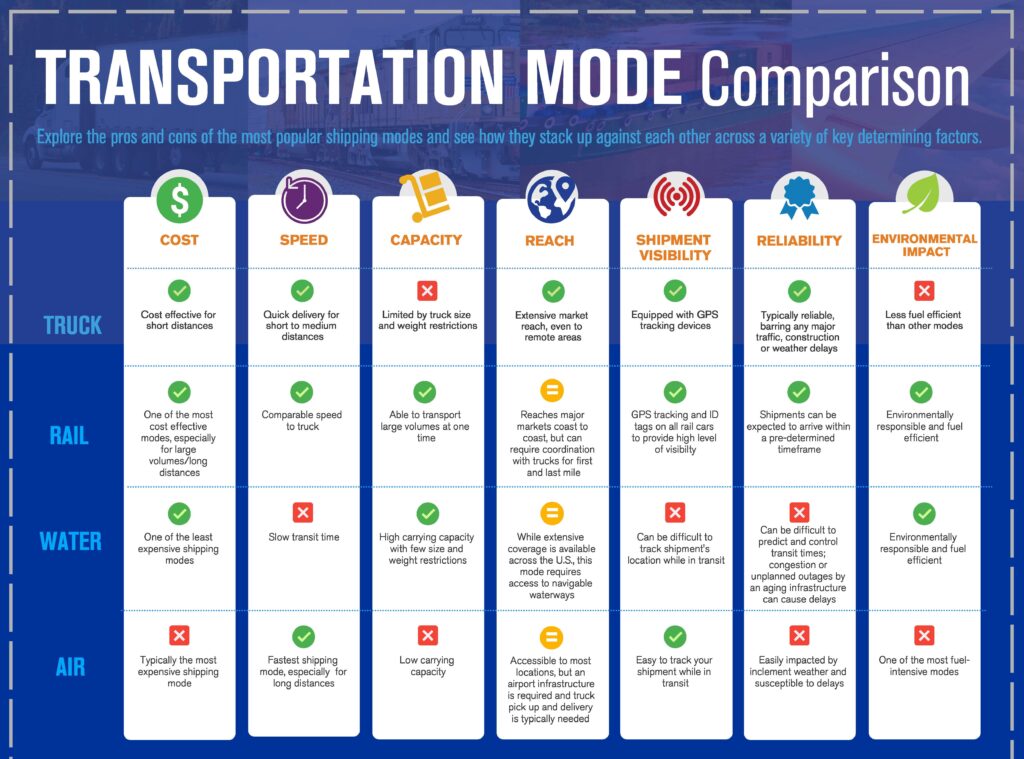

The market ultimately decides how it ships products. The market has been preferentially choosing trucking as a priority over intermodal, although rail has made some inroads on specific lanes. The explanation for the shift is complex. Many factors have contributed relating to service parameters such as time-to-market for shipped products, differences in in-process-inventory required for different modes of transport, reliability to deliver as scheduled, convenience, extent of customer-centric operation, and more.

While the potential is there for reduced net emissions through optimizing intermodal use, that opportunity has a great deal of complexity and history. The potential is real for intermodal operations using containers to be tools for reducing carbon emissions, however, there are also significant operational, economic and regulatory challenges versus alternative modes of transportation like trucking.

Understanding the future potential for rail intermodal transportation to reduce emissions requires some perspective on the history of railroads in North America. The story of trains is one of successes and failures in an endless pursuit of profitability. That pursuit has often impacted customer service metrics.

As new technologies enter production, such as battery electric and fuel cell electric powertrains, there is a significant potential to improve the environmental impact of both rail and truck transport. Interim energy solutions such as renewable natural gas, renewable diesel, and green hydrogen may also keep vehicles moving on internal combustion engines, while concurrently reducing the impact of their emissions as technologies and regulations evolve.

The opportunity to reduce emissions by proportionally moving more freight by rail versus trucks is a complex challenge. Increasing rail intermodal use by capturing market share from trucking’s long-haul segment would inherently increase regional and short urban haul truck market share.

Recommendations

As result of its work, the study team has identified three significant opportunities to reduce freight related emissions.

- Shift more market share from regional and long-haul trucking to intermodal rail.

- Replace traditional diesel drayage tractors with zero-emission and near-zero emission tractors.

- Replace traditional diesel terminal tractors with zero-emission and near-zero emission tractors.

Trucks are quicker than locomotives to transition to new technologies because the useful asset life of a truck may be less than 15 years whereas locomotives may have asset lives of 50 years.

However, the aging North American locomotive fleet offers opportunity to make significant steps in new zero-emission locomotive technology once it becomes available.

Increasing intermodal rail freight from long-haul on-highway operations on select routes can reduce net emissions, but the opportunity may be tempered if the required drayage trucking demands at both ends of the rail line have significant mileage requirements.

Rail must improve its customer service focus, refining on-time reliability and shortening time in transit to better compete with trucking.

Many trucking companies can share one highway, where most Class I rail lines are dominated by their primary owner. This leads to challenges in providing competitive rail services to customers located on or near those rail lines. Improved flexibility with reciprocal switching could increase customer demand for rail services through greater rail company competition.

Conclusions

Railroading and trucking are intertwined freight segments that both compete and complement each other. Both are viable alternatives for moving freight but differ in focus, with trucks generally being faster and more flexible. Railroads can offer lower costs and greater volumes on specific lanes.

- The competitive relationship between rail and trucking has seen trucking take the lion’s share of market. The two, however, are linked as shipping rates are tied to supply and demand on the two transportation modes. Greater use of one invariably drives volume done in the other and hence drives market rates down making them more attractive to shippers. If rail or trucking assets are operating at capacity, the other mode has opportunities to capture market share because the freight must move.

- Intermodal railroading and drayage trucking are a subset of the relationship between rail and trucking, wrapped inside the ubiquitous shipping container. Growth in intermodal rail operations inherently means growth in regional and urban short-haul trucking as trains do not go everywhere that trucks can. For this reason, predicting the net emissions benefits of greater intermodal use is much more complex than just replacing a long-haul truck with a train over a common distance.

- Intermodal terminals are not located everywhere. Six major Class I railroads have differing service networks in North America. Freight generally has to be moved both to and from these terminals by drayage trucks, and some of these may go extreme distances. Intermodal operations do not supplant trucks, they only migrate their usage to different routes and distances.

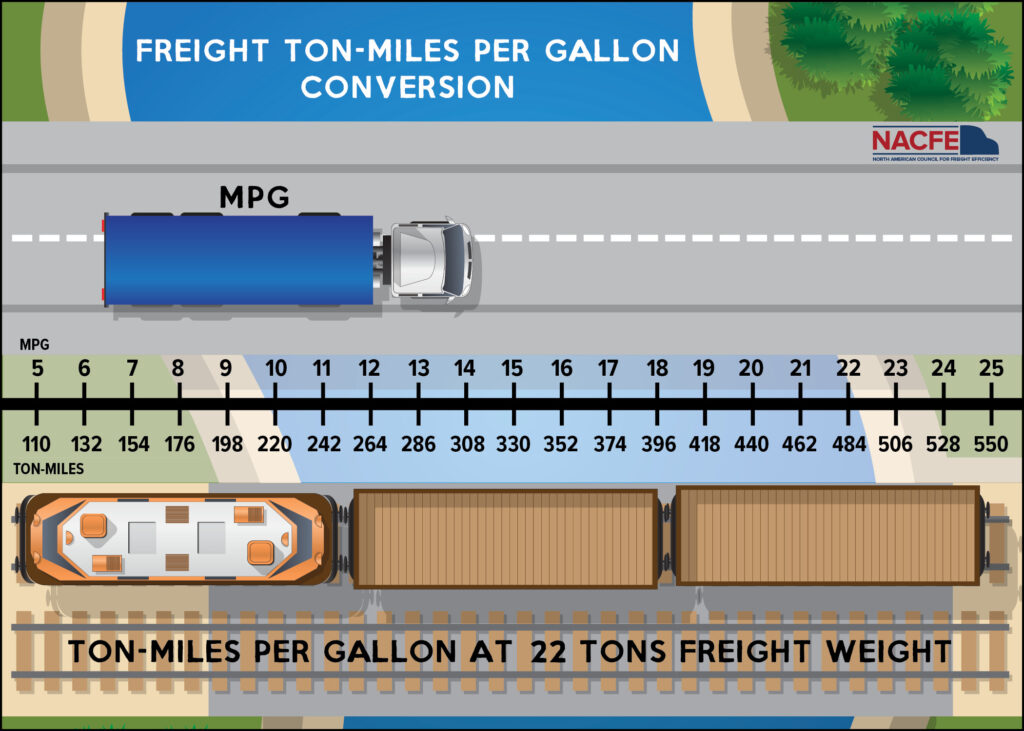

- Overly simplistic comparisons of emissions savings of using rail versus trucks abound. New low- and zero-emission technologies in trucking are also greatly shortening the emissions gap between rail and trucking.

- Intermodal rail combined with zero-emission drayage vehicles are capable in combination of reducing freight emissions versus traditional diesel long-haul trucking on specific shipping lanes but are not necessarily better on all lanes due to the trackage limitations and market segmentation of the six Class I railroads.