Electric Trucks Have Arrived: Documenting a Real-World Trucking Demonstration

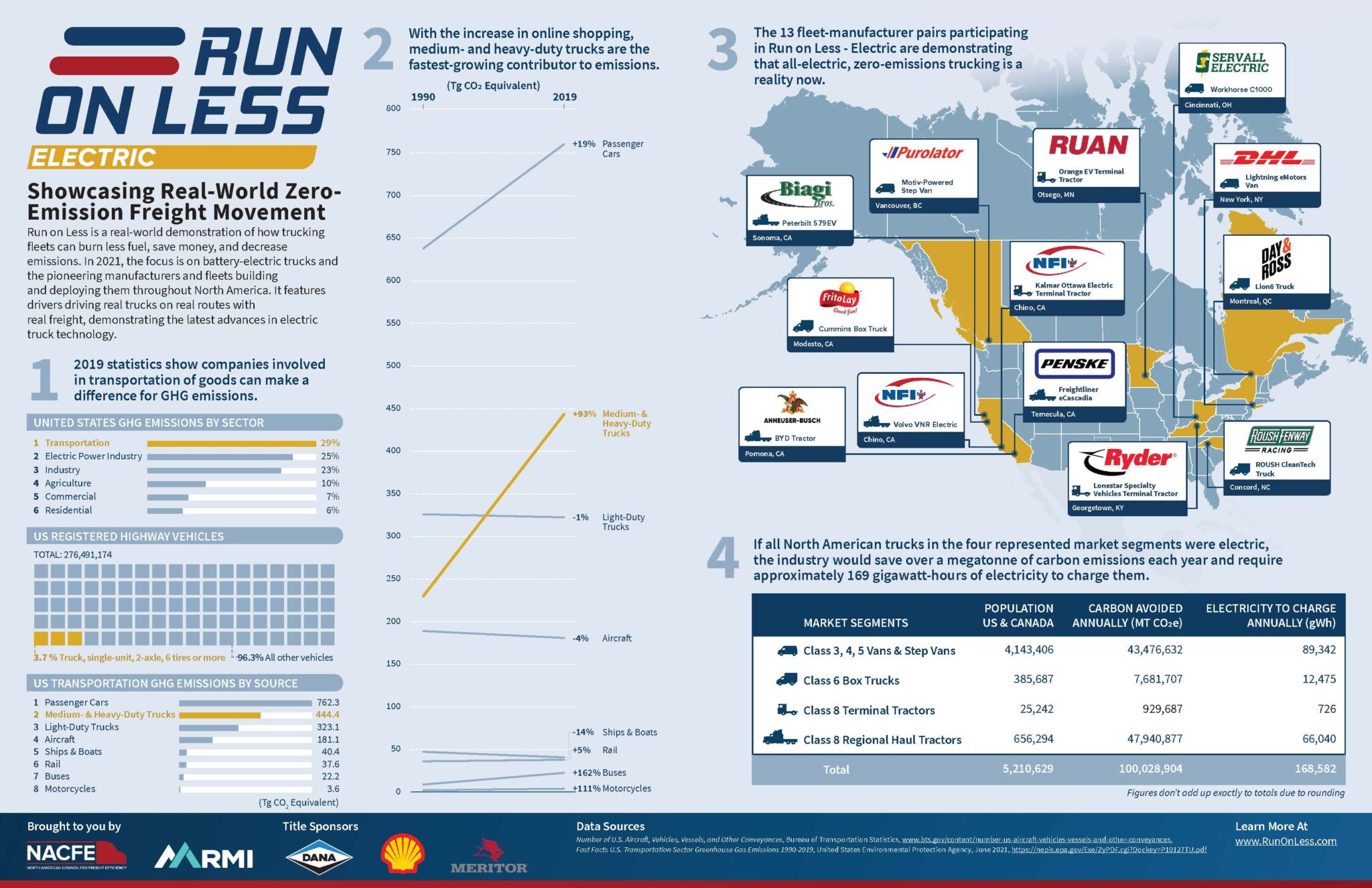

The Run on Less – Electric demonstration showed that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors and heavy-duty regional haul tractors — commercial battery electric vehicles (CBEVs) are a viable option for fleets.

Thirteen fleet-OEM pairs participated in the Run:

- Anheuser-Busch with a BYD tractor

- Frito-Lay with a Cummins box truck

- Penske with a Freightliner eCascadia

- NFI with a Kalmar Ottawa terminal tractor

- DHL with a Lightning eMotors van

- Day & Ross with a Lion6 truck

- Ryder with a Lonestar Specialty Vehicles terminal tractor

- Purolator with a Motiv-Powered step van

- Ruan with an Orange EV terminal tractor

- Biagi Bros. with a Peterbilt 579EV

- Roush Fenway Racing with a ROUSH CleanTech truck

- NFI with a Volvo VNR

- Servall Electric with a Workhorse C1000

How It Worked

This report’s conclusions were generated through data collection and calculations from Run on Less – Electric. Twelve of the 13 vehicles were equipped with Geotab devices that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries. Data for one fleet was collected via the OEM’s own telematics device.

Results

RoL-E demonstrated that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors, and heavy-duty regional haul tractors — the technology is mature enough for fleets to be making investments in production CBEVs. Continuous improvement is expected to be rapid as these technologies gain market share. The environmental benefit of reduced CO2 and particulate emissions is significant for replacing traditional diesel and gasoline-based vehicles.

Additional Findings Include:

- Early adopters of CBEVs are validating an acceptable total cost of ownership in urban medium-duty vans and trucks, terminal tractors and short heavy-duty regional haul applications.

- CBEV adoption is occurring throughout North America, but use of longer haul heavy-duty electric semi-trucks has been somewhat limited to California.

- There are benefits to CBEVs (quiet operation and reliability) as well as challenges (infrastructure and range).

- CBEV truck ecosystem inertia is in its early stages with many solutions emerging that will support adoption in the next several years.

- The industry needs to develop standards in the areas of charging, repair, maintenance and training.

- There is a huge demand for real-world information on electric vehicles in commercial applications and on charging infrastructure.

- The mix of startups, traditional truck OEMs, and component manufacturers is expediting the development of creative and practical solutions.

- More thought is needed on the best way to gather and manage the necessary data for fleets and manufacturers to measure and monitor their CBEVs.

- Early adopters of CBEVs are having an influence on improving trucks and infrastructure.

- CBEVs present operational challenges, for example longer charging times than fueling, which these fleets are working to mitigate.

Other Considerations

There is concern about the impact of both high and low temperatures on the performance of CBEVs, but because CBEVs are relatively new entrants into the trucking industry, many of the RoL-E fleets did not have firsthand experience in operating in a variety of weather conditions.

However, RoL-E fleets in Minnesota and New York City have operated their CBEVs through the winter with no performance issues. In addition, the Southern California and Modesto area sites saw extreme heat during the summer with drivers and fleet managers reporting no duty cycle limitations during site visits.

The three-week RoL-E demonstration was far too short to get any useful measured detail on maintenance. There is long-term reliability data on electric automobiles and buses showing that once vehicles are in production, their maintenance costs and failure rates trend downward versus internal combustion vehicles. This was the expectation of all the fleets in RoL-E.

Mountains and road grades also demand more energy from the batteries, just as diesels use more fuel climbing hills. What is advantageous, is that CBEVs can recover energy on the downhill segments.

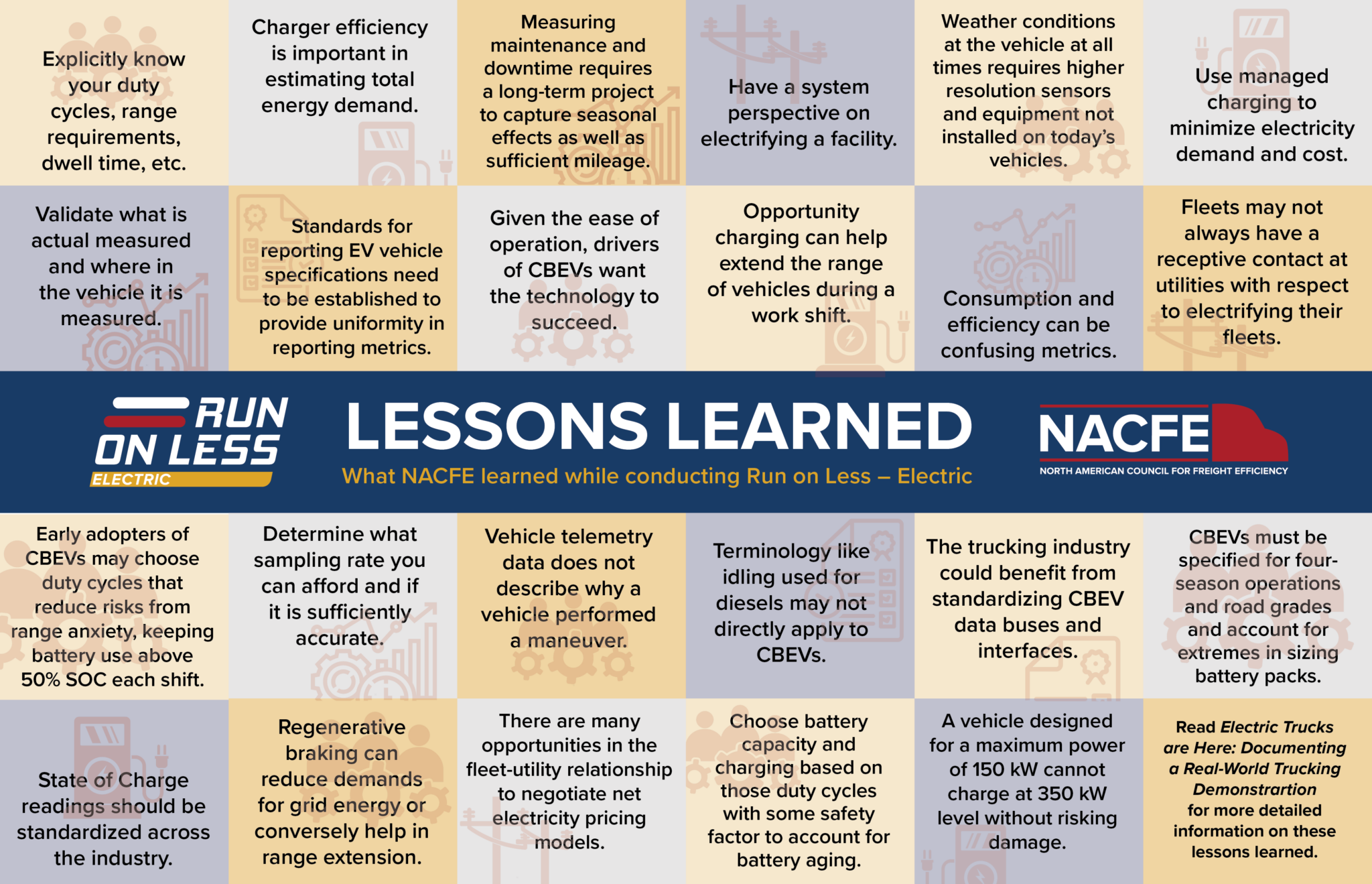

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run in the areas of charging, measuring performance, standardization, operations, and working with utilities.

Conclusions

RoL-E demonstrated that for four market segments — vans and step vans, medium-duty box trucks, terminal tractors and heavy-duty regional haul tractors — the technology is mature enough for fleets to be making investments in production CBEVs.

NACFE encourages fleets to begin deploying CBEVs in these market segments as early adopters are validating an acceptable total cost of ownership in these four market segments.

More details on Run on Less – Electric can be found here.

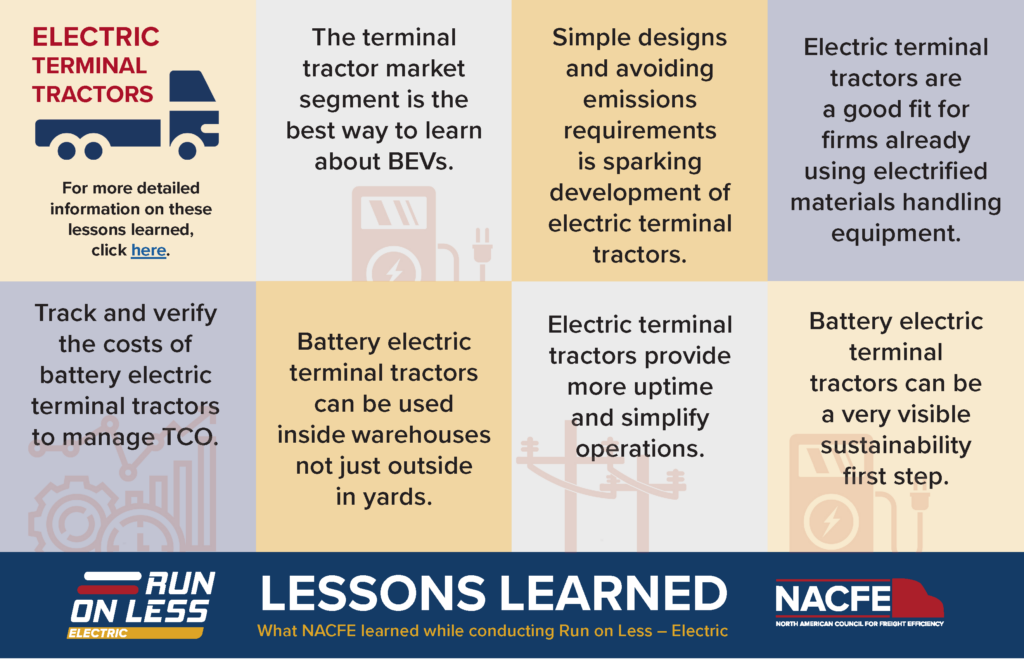

The Case for Terminal Tractors

The Run on Less – Electric demonstration focused on the terminal tractor segment of the trucking industry in addition to vans and step vans, medium-duty box trucks and heavy-duty regional haul tractors.

The three fleet-OEM pairs in the terminal tractor market segment were:

- NFI with a Kalmar Ottawa terminal tractor

- Ruan with an Orange EV terminal tractor

- Ryder with a Lonestar Specialty Vehicles terminal tractor

How It Worked

This report’s conclusions were generated through the data collection and calculations from the three terminal tractors that participated in Run on Less – Electric, interviews conducted with representatives from the participating fleets and tractor builders and input from other industry experts.

Of these three vehicles, two were instrumented with a Geotab telematics device, and one had its data collected via the manufacturer’s own telematics device. The telematics devices tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries.

Results

Run on Less – Electric demonstrated that in the terminal tractor market segment the technology is mature enough for fleets to be making investments in production battery electric terminal tractors.

Additional Findings Include:

- NACFE considers terminal tractors one of the best, if not THE best, paths for a heavy-duty tractor fleets to learn about and implement a BEV in a fleet operation.

- The drivers in Run on Less – Electric all rave about their vehicles’ quieter operation and improved performance. All the drivers mentioned that they liked the responsiveness of the battery electric terminal tractor, and they also liked the regenerative braking feature once they got used to it.

- The maintenance cost of a battery electric terminal tractor compared to the most recent diesel-powered terminal tractors (2017 and later with DPF and SCR aftertreatment systems) is dramatically reduced (approximately 60% to 75%).

- Battery electric terminal tractors have a positive environmental impact and will contribute to overall business sustainability goals.

- Payback times for a battery electric terminal tractor compared to diesel-powered units are currently long for most applications (eight or more years) without incentives and other factors to help the TCO calculation.

- Tracking the vehicle to verify the cost benefits can be very difficult without significant prior planning.

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run specific to terminal tractors.

Conclusions

The terminal tractor market globally is estimated to grow from about $700M in 2021 to more than $850M in 2026.

Based on the duty cycle and frequency of intermittent charging, fleets may be able to reduce the battery pack size, which will lower the overall cost of the vehicle without sacrificing performance.

If 100% of the terminal tractors in the US and Canada were electrified, it would require approximately 726 gWh of electricity for charging and result in the avoidance of 929,687 MT CO2e annually. (e equals carbon dioxide equivalent.)

More details on Run on Less – Electric can be found here.

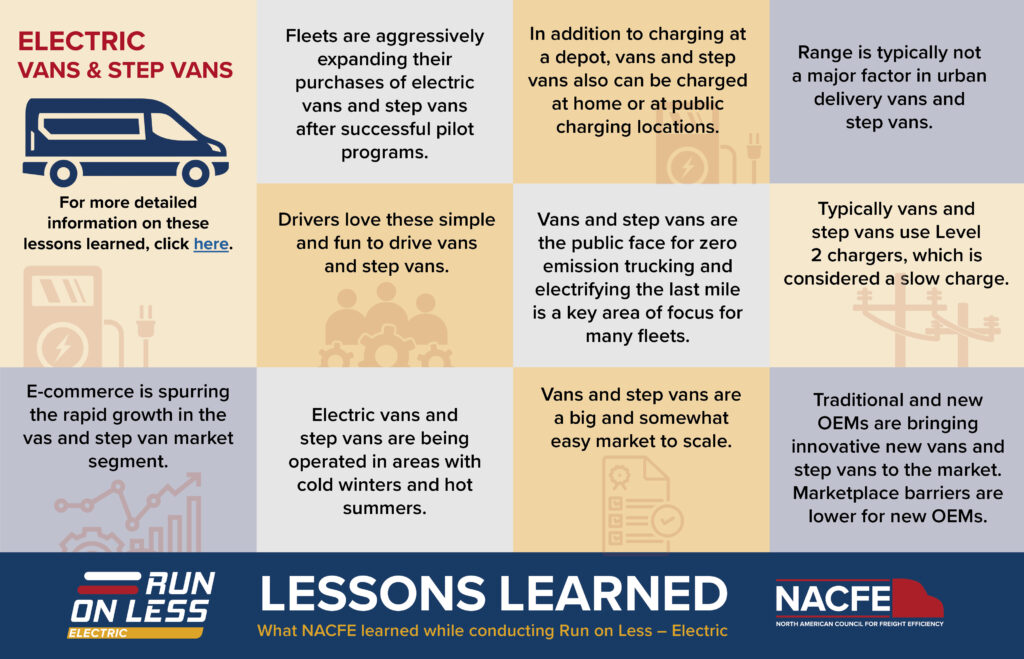

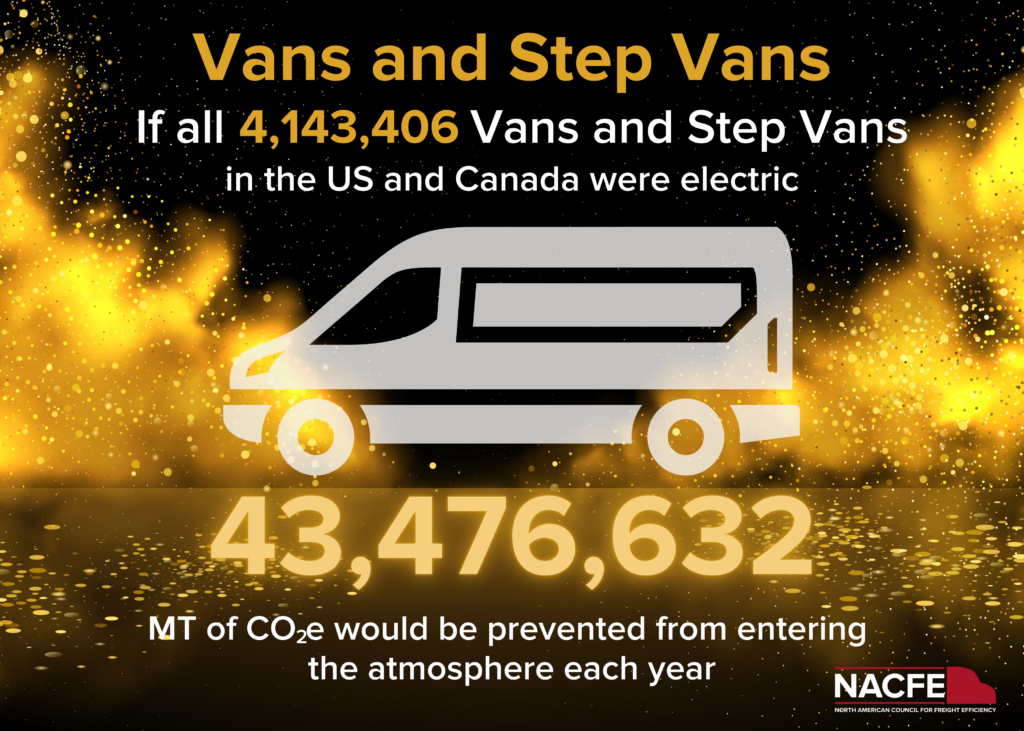

The Case for Vans & Step Vans

The Run on Less – Electric demonstration focused on the van and step van segment of the trucking industry in addition to medium-duty box trucks, terminal tractors and heavy-duty regional haul tractors.

The three fleet-OEM pairs in the terminal tractor market segment were:

- DHL with a Lightning eMotors Ford Transit 350 HD Class 3 van

- Purolator with a Motiv EPIC Class 6 step van

- Servall Electric with a Workhorse C1000 Class 4 step van

How It Worked

This report’s conclusions were generated through the data collection and calculations from the three vans and step vans that participated in Run on Less – Electric, interviews conducted with representatives from the participating fleets and tractor builders and input from other industry experts.

All three vehicles were instrumented with a Geotab telematics device that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries.

Results

Run on Less – Electric demonstrated that in the van and step van segment the technology is mature enough for fleets to be making investments in production battery electric vans and step vans.

Additional Findings Include:

- E-commerce is leading the doubling of the huge van and step van market. The continued growth of e-commerce, coupled with customer demand for faster, cheaper shipping, and the need for last mile delivery solutions, will likely drive growth in the van and step van market segment over the next decade.

- Everything around electrifying smaller commercial vehicles is easier and the TCO for this market segment is approaching parity with diesel and gasoline powered vehicles. Battery technology today meets the operational requirements for smaller commercial vehicles, especially in the Class 3 to 6 range. The battery packs are smaller and don’t impact cargo capacity or payload. Additionally, because these vehicles are typically used in single-shift operations, fast charging is not necessary. This lowers the power requirements thereby reducing the total cost of charging and infrastructure.

- Improves driver attraction and retention. Many drivers of these vehicles have not driven trucks before, and the ease of operation will be key to attracting them. Reliability and improved working environment are not the only benefits drivers see with electric vans and step vans. There also is a definite “cool” factor when it comes to interacting with the public. Drivers tell NACFE they get a lot of interest about the electric vehicles they are driving, from both their peers and their families.

- Transition will be challenging, but planning can mitigate risks. Even though electrifying smaller commercial vehicles is easier, the transition still will be difficult. Electrification will not happen overnight or in a silo. Redesigning parking lots and depots to support electrification will take time, effort, and money. Thoughtful planning during the design phase at new sites can help fleets mitigate some of the challenges existing sites will experience as they work toward electrification.

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run specific to vans and step vans.

Conclusions

Multiple sources indicate that 50% to 60% of active registered vehicles are in Class 3 to 6 — some 4.2 million in the US and 0.53 million in Canada. NACFE’s conservative estimate of active Class 3, 4, 5 and 6 vans and step vans in the US and Canadian market is approximately 4.2 million vehicles. The market for urban delivery vans could double between 2021 and 2026, based in large part on the growth of e-commerce.

If 100% of the vans and step in the US and Canada were electrified which would result in the avoidance of 43,476,632 MT CO2e annually (e equals carbon dioxide equivalent).

More details on Run on Less – Electric can be found here.

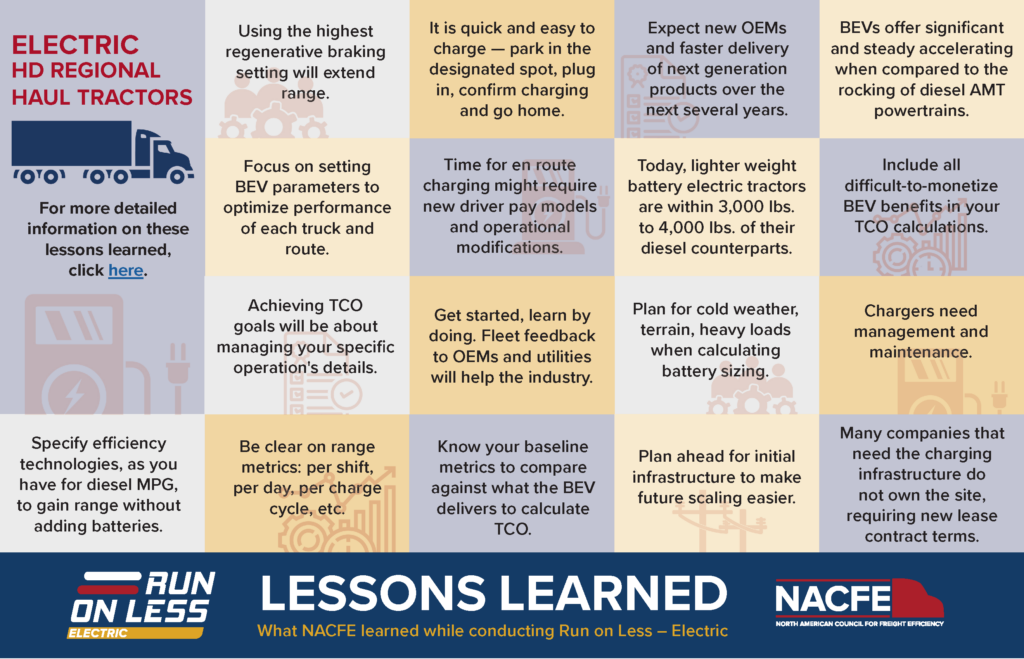

The Case for HD Regional Haul Tractors

The Run on Less – Electric demonstration focused on the heavy-duty regional haul tractors of the trucking industry in addition to medium-duty box trucks, terminal tractors and vans and step vans.

The four fleet-OEM pairs in the heavy-duty regional haul tractor market segment were:

- Anheuser-Busch with a BYD 8TT tractor

- Biagi Bros. with a Peterbilt Model 579EV

- NFI with a Volvo VNR Electric

- Penske with a Freightliner eCascadia

How It Worked

This report’s conclusions were generated through the data collection and calculations from the four heavy-duty regional haul tractors that participated in Run on Less – Electric, interviews conducted with representatives from the participating fleets and tractor builders and input from other industry experts.

All four vehicles were instrumented with a Geotab telematics device that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries.

Results

The Run on Less – Electric demonstration and subsequent research indicate that in the heavy-duty regional haul tractor market segment, 50% of those vehicles are electrifiable now.

Additional Findings Include:

- NACFE considers short and medium regional heavy-duty tractors electrifiable today with their range of 200 miles, about 3,000 to 4,000 lbs. of freight capacity penalty compared to diesels and improving total cost of ownership when monetizing all benefits. Regional haul tractors perform in various duty cycles including out-and-back, hub-and-spoke and diminishing return. Tractors currently available are meeting the needs of about 50% of this market segment.

- Regional haul tractors return to base daily giving fleets confidence about making investments in charging infrastructure. These trucks often have 10+ hours of overnight dwell time for charging. Many people mistakenly assume Class 8 heavy-duty tractors are used in mostly long-haul disparate routes. In fact, only 40% are used in long-haul and 30% are vocational trucks and regional haul tractors respectively. These regional haul tractors are good candidates for electrification due to their shorter daily distances and return to base operation.

- Operational changes such as the choices of the truck for each daily route, en route opportunity charging, driver incentives and managed charging are all examples of actions to improve the TCO of heavy-duty regional haul BEVs. Many actions are emerging to improve the TCO of operating electric vehicles in this market segment with many having to do with increasing range. Batteries are expensive and heavy so fleets can reduce the up-front cost by taking actions to extend the range. Others include lowering other costs such as charging during off peak hours.

- The drivability (particularly in getting up to speed), quietness and other aspects make these trucks ones that drivers prefer over diesels, improving driver attraction and retention for fleets. Drivers of all sizes of electric vehicles share how much they like the driving experience over internal combustion engines. For regional haul driving much time is spent accelerating to highway speeds and this specific aspect of day cab electric tractors definitely will help attract and retain drivers in this segment.

- Some medium and longer regional haul duty cycles pose more demanding requirements for current BEVs, but the next generations of products are bringing larger battery packs, better performing systems and lighter solutions to improve the TCO. Incentives are key to help the financials for these applications. NACFE defines medium and longer regional haul as vehicles that return to base frequently and travel in a radius of 100 to 200 miles or 200 to 300 miles respectively. Improvements are needed to make these vehicles – with their more than 150 and up to 600 miles of range – acceptable for total cost of ownership operations.

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run specific to heavy-duty regional haul tractors.

Conclusions

Heavy-duty regional haul battery electric trucks are viable solutions today for improving fleet freight efficiency and helping achieve sustainability goals on short and some medium length routes where daily mileage is 200 miles with one shift return-to-base operations where overnight vehicle dwell time allows for lower cost overnight charging. Other variations of duty cycles also may be very viable where higher rate en route charging can extend vehicle range.

As Run on Less – Electric concluded in September 2021, NACFE predicted that 70% of this market segment was electrifiable. Given the more detailed analysis, interviews with industry experts and further research for this report, we now consider this market segment to be 50% electrifiable with lower average daily miles which results in the avoidance of nearly 29.4 million metric tonnes CO2e annually (e equals carbon dioxide equivalent). NACFE estimates the entire CO2e to be eliminated by this segment at an average of 250 miles per day to be 97.8 million metric tonnes.

More details on Run on Less – Electric can be found here.

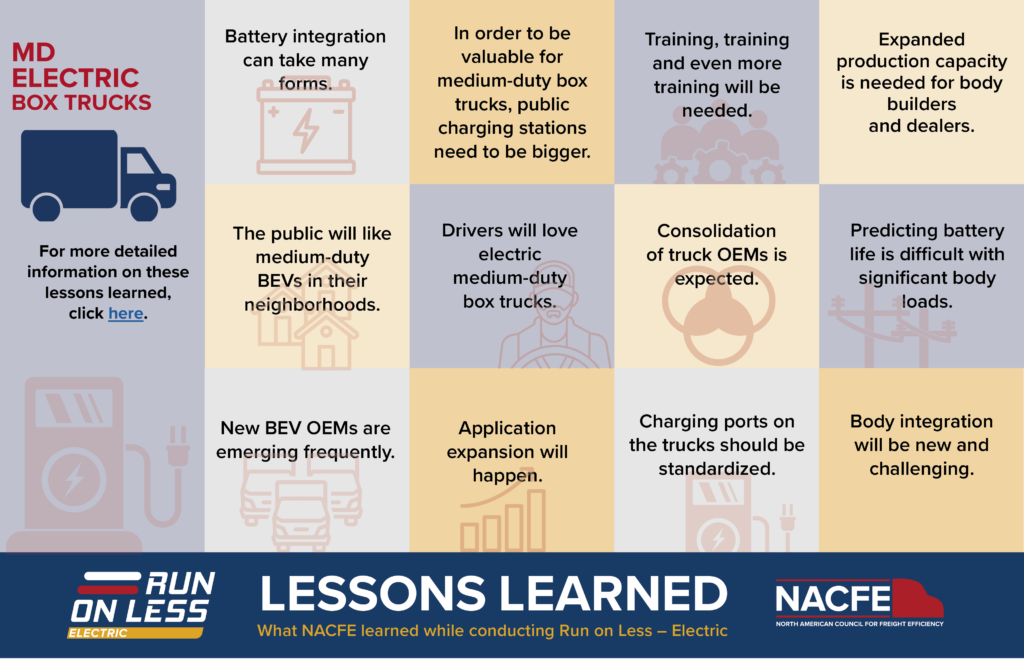

The Case for MD Box Trucks

The Run on Less – Electric demonstration focused on the medium-duty box truck segment of the trucking industry, in addition to terminal tractors, vans and step vans and heavy-duty regional haul tractors.

The three fleet-OEM pairs in the medium-duty box truck market segment were:

- Day & Ross with a Class 6 Lion6

- Frito-Lay with a Class 6 Peterbilt-Cummins 220EV

- Roush Fenway Racing with a Class 6 ROUSH CleanTech Ford F-650

How It Worked

This report’s conclusions were generated through the data collection and calculations from the three medium-duty box trucks that participated in Run on Less – Electric, interviews conducted with representatives from the participating fleets and tractor builders and input from other industry experts.

All three vehicles were instrumented with a Geotab telematics device that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries.

Findings

The study team has five key findings based on the three battery electric medium-duty box trucks that participated in RoL-E.

- Medium-duty box trucks are a great application for electric trucks given their short distances and return-to-base operations. The vast majority of medium-duty box trucks are not driven long distances and are home every night. They are an ideal portion of the overall medium-duty truck market for electrification. Other medium-duty applications that do not require much battery power to operate aspects of the body also can be good candidates for electrification.

- Medium-duty trucks almost always have a second manufacturer who adds body devices requiring engineering design and validation as well as manufacturing planning for electrification. Truck equipment manufacturers (TEMs), also known as body builders, will be adding a wide variety of bodies to medium-duty chassis. While a simple van body doesn’t require a lot of additional engineering or validation, many other applications will be much more challenging in terms of installation, operations, safeguards and more.

- More complex Class 6 and 7 trucks such as snowplows, refuse trucks, and fire trucks will require significant efforts which will delay electrification timing. Trucks that see continuous operations for a day or more such as a snowplow or utility truck, will be obvious challenges for battery electric powertrains. This isn’t to say that some prototypes will be developed and shown, but they are less likely to be seen in significant volumes in the near future.

- Application expansion into more complex medium-duty trucks will occur as knowledge is gained. Tackling relatively simple and straightforward applications such as box trucks provides the trucking industry with a launching point to design, build, validate and refine battery electric trucks. The industry will learn things such as how much of the battery is consumed by various cab air conditioning and heating demands. It also will learn about how lift gates and other peripheral devices tax power consumption. This knowledge can be carried over to more difficult applications, providing a “known step” as the industry works through the issues in other more complex applications.

- Other aspects such as driver attraction and retention benefits, maintenance savings and infrastructure challenges exist as they have for other market segment use cases. Battery electric trucks will offer both benefits and challenges. Finding grants and incentives to make the vehicles more affordable is not easy and available funds disappear quickly when they become available. Charging infrastructure presents an entirely new set of challenges for fleets from parking lot planning, to building permits, inspection approvals and operations. What has been very positive is the response of the drivers that have driven these electric trucks. The vehicles offer many positive attributes that drivers find attractive at a time when drivers are hard to both find and keep; these differences can be valuable.

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run specific to medium-duty box trucks.

Conclusions

NACFE believes that 100% of the medium-duty box truck market segment will embrace electrification although some applications within the duty cycle will be easier to electrify than others that have more complex bodies.

When the simpler box truck portion of this market segment, about 380,000 trucks in the US and Canada, electrifies, it will result in the avoidance of 7,681,707 metric tonnes (MT) of CO2e annually. The more complex trucks in this category will also electrify as the medium-duty marketplace expands the electric coverage over the next decade. These trucks cover both freight and work truck use cases.

More details on Run on Less – Electric can be found here.

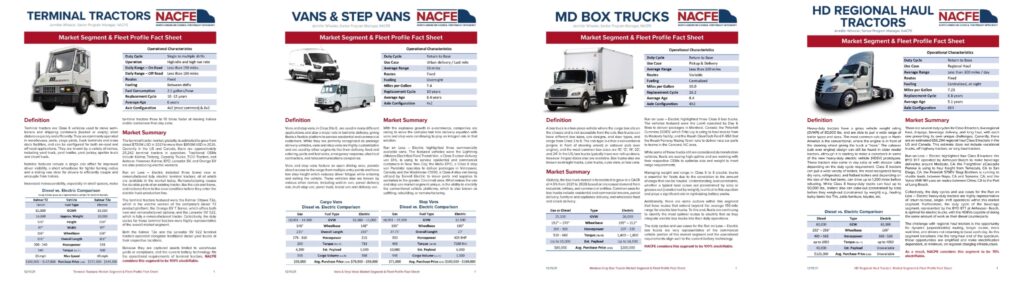

Market Segment Fact Sheets

Run on Less – Electric (RoL-E) was a three-week demonstration, conducted in September 2021, of production level electric commercial vehicles in real-world operations at 13 fleets in regions across North America operating in market segments identified as high potential for employing battery electric trucks. Four segments were included: terminal tractors, vans and step vans, medium-duty box trucks and heavy-duty regional haul tractors.

During the Run, these trucks followed their regular routes delivering beer, wine, packages, electrical equipment, and more.

NACFE created a Fact Sheet for each market segment to explain the types of vehicles in these segments and their duty cycles.