An Important Area to Consider for Improving Fuel Efficiency

The entire weight of the tractor-trailer rides on the tires, generating rolling resistance – and making tires an important area to consider for improving fuel efficiency.

Tire manufacturers have improved both the dual configurations for lower rolling resistance and developed single wide tires, which lower the contact area, improving fuel efficiency and providing weight savings. Aluminum wheels and tire pressure systems improve freight efficiency in the wheel system. Tire wear and susceptibility to damage should be key considerations when trying to optimize this area of the vehicle.

Tires, Rolling Resistance

It is all about payback. The shorter the better, no matter what the cost.

– Truck OEM Product Manager

Tire Pressure Inflation

Proper tire inflation pressure is critical to the optimal operation of a commercial vehicle. Underinflated tires result in decreased fuel efficiency and increased tire wear. A 0.5-1.0% increase in fuel consumption is seen in vehicles running with tires underinflated by 10 psi. Having appropriate pressure reduces tire wear, increases fuel efficiency, and leads to fewer roadside breakdowns due to tire failures.

However, studies show that:

- About one out of five tractors/trucks is operating with one or more tires underinflated by at least 20 psi.

- About one in five trailers is operating with one or more tires underinflated by at least 20 psi.

- Nearly 3.5% of all tractors/trucks operate with four or more tires underinflated by at least 20 psi.

- 3% of all trailers operate with four or more tires underinflated by at least 20 psi.

- Approximately 3% of all trailers, and more than 3% of all tractors/trucks, are operating with at least one tire underinflated by 50 psi or more.

- Only 46% of all tractor tires and 38% of all trailer tires inspected were within +/- 5 psi of the target pressure.

Automatic tire inflation systems (ATIS) work to overcome one or more of the causes of tire underinflation by monitoring tire inflation pressure relative to a pre-set target and re-inflating tires whenever the detected pressure is below the target level. The system alerts the driver that the tires are being re-inflated but does not report on the actual tire pressure. The system relies on the vehicle’s compressed-air tanks or draws air directly from the surrounding environment using a self-contained pump.

There are two types of ATIS. One system is a traditional compressor-based type that provide air pressure from the tractor to the tire. One version of this type uses internal pressurized axles like a trailer system while the other uses external air line routing under the fifth wheel around the tire valve stem. The other system is self-contained compressing direct atmospheric air and mounting on the end of the axle, generating its own air pressure at each wheel end position and connecting to the valve stem for either duals or wide based singles.

Approximately 15% of tractors and 85% of trailers are equipped with tire pressure inflation systems installed.

Benefits

Fuel Savings

The system keeps tires properly inflated, which reduces rolling resistance and improves fuel economy.

Increased Tire Life

Operating on low pressure causes premature tire wear; by keeping tires properly inflated tire life is improved.

Improved Safety & Fewer Roadside Breakdowns

Very low tire pressure can cause a tire to rupture causing a roadside breakdown. These systems keep tires inflated to their proper pressure level, and reduce roadside breakdowns.

Automatic Tire Inflation

The system eliminates the need for manual intervention in the event of low tire pressure.

Balanced Pressure in Dual Tire Assemblies

The system maintains the tire pressure difference between the two tires in a dual assembly to 5 psi or less.

Enables Remote Monitoring

Tire condition can be monitored remotely via telematics.

Challenges

Poor Inspections

If drivers are overly reliant on a tire pressure system and start up the truck before inspection it is possible for tractor air fed tire inflation systems to pump up the tire before the driver inspects it, thereby masking the issue. Pre-trip inspections should not be replaced by technology.

Potential System Damage

Systems that use tractor air with externally routed lines to inflate the tires much have air plumbing that reaches over the outside of the tire to the wheel end.

Wheel Covers

Because the system does not correct self-contained systems and axle air fed systems will accommodate the installation of aerodynamic wheel covers.

Movement Required for Inflation

Self-contained solutions compress air as the tire is in motion. Until the vehicle has traveled for while the tire(s) may not be operating on full pressure.

Steer Axle

Not all systems are easy to implement on the front steer axle.

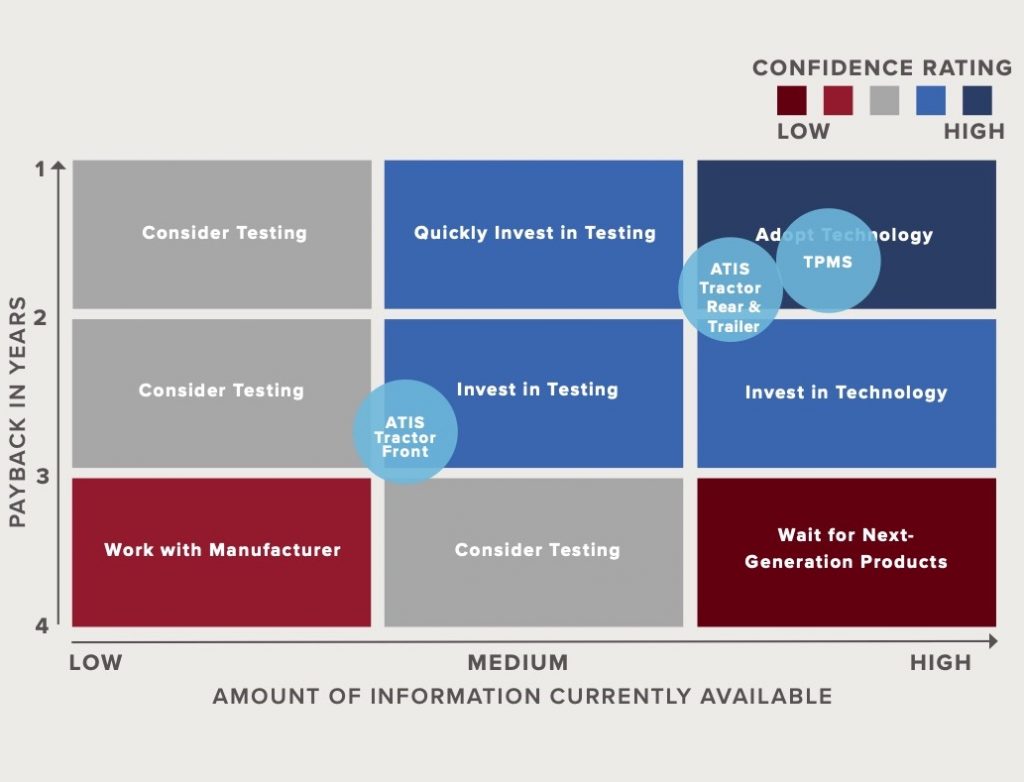

To learn more, download the Tire Pressure Systems Confidence Report.

Tire Pressure Monitoring

Proper tire inflation pressure is critical to the proper operation of a commercial vehicle. Correct tire inflation reduces tire wear, increases fuel efficiency, and leads to fewer roadside breakdowns due to tire failures.

However, studies show that:

- About one in five trailers is operating with one or more tires underinflated by at least 20 psi.

- Nearly 3.5% of all tractors/trucks operate with four or more tires underinflated by at least 20 psi.

- 3% of all trailers operate with four or more tires underinflated by at least 20 psi.

- Approximately 3% of all trailers, and more than 3% of all tractors/trucks, are operating with at least one tire underinflated by 50 psi or more.

- Only 46% of all tractor tires and 38% of all trailer tires inspected were within +/- 5 psi of the target pressure.

Tire pressure monitoring systems (TMPS) monitor pressure and, in some cases, temperature, for each individual tire using various sensor locations and warning methods. In most cases the system will transmit the data and display it to the operator and/or fleet. The TPMS monitors each tire based on a pre-set target pressure, and issues alerts based on the difference between the target pressure and the actual measured pressure in the tire.

Approximately 25% to 30% of tractors and 15% of trailers are equipped with tire pressure monitoring systems.

Benefits

Fuel Savings

The system keeps tires properly inflated, which reduces rolling resistance and improves fuel economy.

Underinflation Warning for Drivers

Drivers get real-time notification of pressure loss, allowing them to add air to the tires before damage occurs.

Reporting on Tire Condition

The sensors tell the exact temperature and inflation pressure of the tire so drivers will know how serious the condition is.

Tire Pressure Reporting by Wheel Position

Drivers know exactly which tire is underinflated and don’t have to walk around the truck trying to figure out where the problem tire is.

Enables Remote Monitoring

Tire condition can be monitored remotely via telematics.

Challenges

No Inflation Capability

Tire pressure monitoring systems do not inflate an underinflated tire. They only inform the driver of underinflation.

Possible False Positives

The system may report false positives of underinflation.

Stops Required

Because the system does not correct underinflation, the driver must stop the vehicle to correct the underinflation.

Fleet Perspectives

Fleets are realizing that their current tire pressure maintenance practices, which typically consist of having drivers manually check tire pressure, are not sufficient to keep the tires inflated to their proper levels.

Most fleets interviewed recognize the benefits of proper tire pressure and are considering the adoption of technologies that better ensure that tractor and trailer tires are properly inflated.

Fleets also shared that that tire pressure monitoring systems can offer enough value that they would consider retrofitting them on tractors and trailers which had enough life left in them to justify the expense.

Early adopters of tire pressure monitoring systems include tankers, vehicles with high trailer miles and/or low trailer-to-tractor ratios and vehicles with duty cycles that have diminishing loads.

Decision-Making Tools

The NACFE team developed a decision making tool to help fleets make decisions about purchasing TPMS. The Confidence Matrix summarizes the study findings and indicates NACFE’s confidence in the various tire pressure monitoring systems.

Conclusions

The currently available commercial vehicle tire pressure monitoring systems are reliable and durable. There are strong options for various truck duty cycles and fleet business models.

Manufacturers continue to develop system for improved performance, better reliability and lower overall costs. As systems become more available from the tractor and trailer manufacturers, the quality of the installation increases and costs decrease. This should lead to increased adoption of tire pressure monitoring systems.

Factors contributing to satisfactory operation of a tire pressure monitoring system include:

- Matching the fleet’s need with the specific capabilities of the various tires pressure monitoring systems currently available;

- Training personnel and developing internal operating procedures around the new tire pressure monitoring system;

- Seamless integration of the TPMS into the fleet’s day-to-day operation.

Low Rolling Resistance Duals

Low rolling resistance (LRR) dual tires will save significant amounts of fuel when compared to tires that are not designed for low rolling resistance.

Cost per mile of tires has traditionally been defined in terms of initial purchase and tread life. However, the cost of fuel the tire consumes because of rolling resistance is five times greater than the initial purchase price of the tire. Rolling resistance makes up 30-33% of the total fuel cost of a Class 8 truck or about $0.13 per mile. The typical purchase price of the tire is about $0.038 per mile.

But given the range in rolling resistance among dual tires on the market today, tires could be claiming anywhere from $0.14/mile to $0.28/mile in fuel costs. Put simply, fleets that are purchasing tires without considering the fuel expenditure impacts of those tires are going to be miscalculating the impact of their tires on their bottom line.

Some of the costs to operate low rolling resistance tires may be higher than those of non-LRR tires, but those costs are recovered over the life of the truck. The cost of the fuel a tire consumes due to its rolling resistance outweighs the initial purchase cost of the tire by a factor of 3.4.

Benefits

Reduced Fuel Consumption

- Since tire rolling resistance accounts for about one-quarter to one-third of truck fuel consumption decreasing by rolling resistance 10% the result is about a 3% decrease in fuel consumption.

- There is a large range of rolling resistance in commercially available tires today, so the fuel efficiency will vary widely.

Sustainability

- Choosing tires from SmartWay’s Verified list of low rolling resistance tires contributes to a fleet’s sustainability goals.

- California regulations call for low rolling resistance tires on certain trucks and tractors.

Initial Purchase Price

LRR tires are priced similarly to, and in some cases less than, non-LRR tires.

Challenges

Irregular/Premature Tire Wear

- Shallower tread can lead to fewer miles overall, but more recent tire advances are extending tire life.

- Some fleets are willing to give up some mileage if the cost of the lost miles can be made up in fuel savings.

Life-Cycle Cost vs. Initial Purchase Price

- Initial purchase price of low rolling resistance tires can be a few percent higher than for non-LRR tires.

- It can be difficult to determine actual fuel savings.

Common Fleet Strategies

Most fleets use the SmartWay verified list as a guide for finding LRR tires. Distributors or tire company representatives can help point fleets to tires that may be best suited for their application. Large fleets may run their own tire tests to determine which LRR tires make the most sense for them.

Premature tire wear is often the symptom of some other problem on the vehicle whether the tires are non-LRR or LRR. Simply replacing a prematurely worn tire with a new tire without addressing the underlying problem will result in premature wear of the new tire as well.

In order not to lose the benefit of LRR tires, fleets should:

- Conduct regular alignment checks,

- Ensure wheels are properly balanced,

- Ensure tires are mounted correctly,

- Keep tires properly inflated,

- Make sure tire diameters are matched for dual tires.

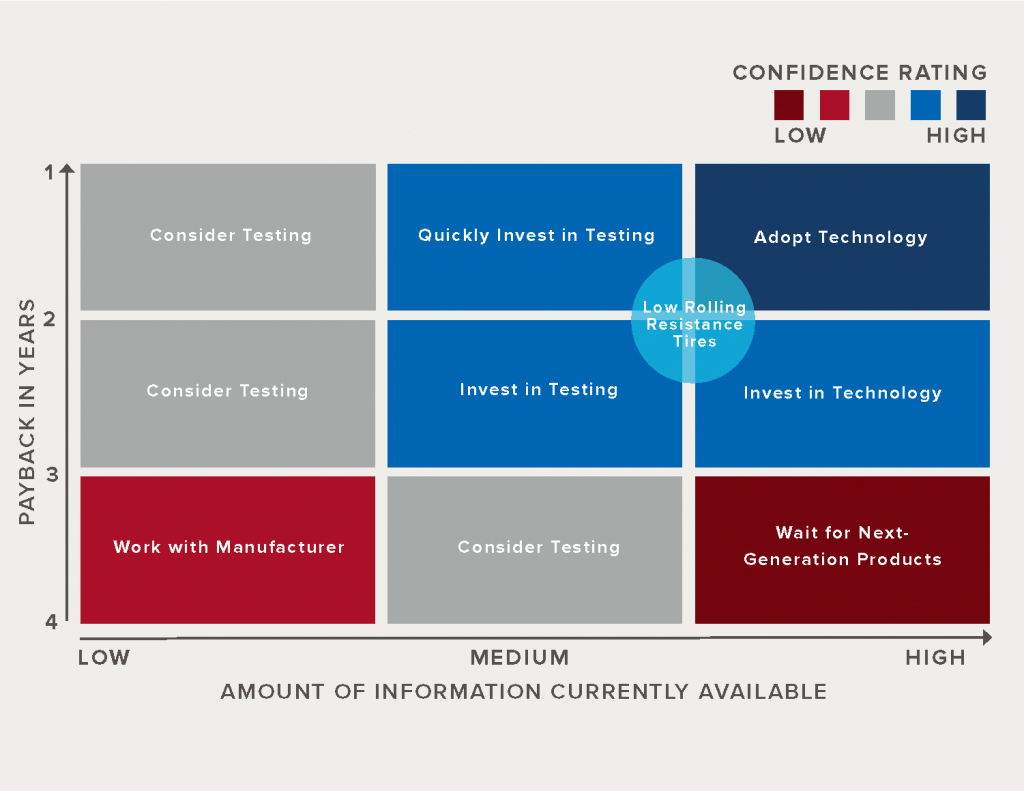

Decision-Making Tools

NACFE developed several tools including a Confidence Matrix, decision guide and payback calculator to assist fleets in evaluating low rolling resistance tires. The Confidence Matrix shows how confident NACFE is in the adoption case for low rolling resistance duals.

Conclusions

- Low rolling resistance tires, whether in a dual or a wide-base configuration, save significant fuel.

- The purchase price of LRR tires may be higher than non-LRR tires, but these costs can be overcome through fuel savings when considering life cycle cost.

- Adoption of LRR tires in the over-the-road trucking is high and will continue to increase

- The perception of traction issues or driver acceptance problems is worse than the reality.

- The MPG gap between the lowest LRR dual tires and the best wide-base tires continues to narrow.

Recommendations

- Fleets should understand the total life cycle cost for tires in their specific operation, including the up-front purchase price, weight, wear, retreadability, etc.

- Fleets should use the lowest rolling resistance tires for their specific needs from a trusted manufacturer. Tires on the SmartWay Verified List of Low Rolling Resistance New and Retread Tire Technologies meet only a specific rolling resistance threshold and can encompass a wide range of quality, fuel efficiency and service life.

- Tire manufacturers should continue to develop even lower LRR tires while continuing to lessen the tradeoffs in traction and tread life.

- Tire manufacturers should work to agree on a testing protocol, with the goal of making CRR data widely available to tire purchasers.

- Tire manufacturers should publicly share the rolling resistance coefficient (along with wearability and wet traction) for all their tires once industry-wide collaboration and agreement on a standard testing protocol is achieved.

- Tractor and trailer makers and their dealers, industry associations, EPA SmartWay, TMC, NACFE and others can better assist fleets in these decisions by making data more accessible to tire purchasers.

- EPA SmartWay should develop tiers of rolling resistance tire categories to encourage early adopters to utilize the best tires for their needs.

Wide-Base Tires

There is a higher adoption of tire pressure systems by fleets that use wide-base tires.

Wide-base tires intended for the over-the-road line-haul market will save significant amounts of fuel when compared to tires that are not designed for low rolling resistance. Wide-base tires generally display lower rolling resistance when compared to equivalent dual tires.

The benefits of wide-base tires compared to duals include up to a 1% reduction in overall vehicle weight, an equivalent upfront purchase price, and the potential for reduced maintenance.

Benefits

Reduced Fuel Consumption

- Lower rolling resistance leads to less fuel consumption.

- There is a large range of rolling resistance in commercially available tires today, so the fuel efficiency will vary widely.

- Because of improvements to LRR duals, the benefit of wide-base tires over duals is only 1% to 2%.

Weight Reduction

Savings can range from 627 to 1,284 lbs.

Initial Purchase Price

There is a negligible price differential between wide-base and dual tires when spec’d with new equipment.

Reduced Maintenance

No need to match tires as in a dual setup, and fewer tires to service reduces time to check pressure and tire condition.

Challenges

Irregular/Premature Tread Wear

- Anecdotal evidence that suggests some wide-base tires are less tolerant of certain maintenance shortcomings, such as bearing adjustment and inflation pressure.

- Tire wear concerns can be more a matter of perception than reality.

Availability

- Product availability was a concern in the early days of wide-base tires.

- Non-users of wide-base tires still cite this as a concern; but more than 90% of tire dealers now stock at least the more popular models of wide-base tires.

Increased Cost of On-road Breakdown

- Labor and service charges connected to a tire failure road call are roughly the same for wide-base or dual tires, so the increased cost of on-road breakdown is more connected to the increased likelihood of wheel damage.

- If a wide-base tire is operated underinflated or flat, wheel damage may be more likely, as there is no companion tire to hold the wheel off the pavement.

Residual/Resale Value

- In some regions wide-base tires are seen as a negative during trade-in.

- Several truck dealerships that the study team spoke with indicated that they preferred trade-ins to have dual tires as they seemed to sell better.

- Used truck dealers with both duals and wide-base tires find the duals are preferred and often replace wide-base singles with duals to make the trucks more marketable.

Ability to Retread

- In the past, wide-base tires have been limited to one retread. However, improvements in casing and the retreading process are allowing additional retreads.

- The brand of tire to seems to be a significant factor in the ability to retread it.

Driver Acceptance

There are perceived concerns over traction and stability.

To learn more, download the Low Rolling Resistance Tires Confidence Report.

Aluminum Wheels

Aluminum wheels can replace steel wheels, reducing the weight of the wheels and improving fuel and freight efficiency. They also are popular in improving the appearance of the vehicle for brand, driver acceptance, and resale value.

Benefits

Fuel Savings

The lower weight of aluminum helps reduce fuel consumption.

Weight Savings

Aluminum wheels can remove hundreds of pounds from the weight of the tractor or trailer.

Appearance

Aluminum wheels are less prone to corrosion so maintain their appearance longer.

Challenges

Initial and Replacement Costs

Steel wheels typically cost less than aluminum wheels.

Nitrogen-Filled Tires

Maintaining proper inflation pressure contributes to fuel efficiency and longer tire life. Using concentrated nitrogen instead of atmospheric air to fill tires can slow down the loss of natural tire pressure in truck tires. Having appropriate pressure reduces tire wear, increases fuel efficiency, and leads to fewer roadside breakdowns due to tire failures.

To fill tires with nitrogen, a membrane process is used to remove oxygen and moisture from the air, which takes advantage of faster permeation rates of these components relative to nitrogen. The highly-concentrated nitrogen gas is collected in a pressurized storage tank, which is then used to inflate tires.

Benefits

Maintaining Original Pressure

Nitrogen-filled tires maintain original pressure longer.

Better Maintenance of Original Pressure

Filling tires with nitrogen slows down the natural loss of pressure.

No Impact on Inner Tire Liners

Because of the inert nature of nitrogen it will not harm tire liners or have an adverse effect on tire performance.

Challenges

Availability of High-Concentration Nitrogen

High-concentration nitrogen may not be readily available. With tires that were initially inflated with nitrogen, adding atmospheric air will result in the loss of benefits provided by the nitrogen.

Dry Air Needed for Optimal Results

Moisture in the air source can promote corrosion or degradation of tires and wheels. Using dry air reduces tire pressure variations resulting from temperature changes.

Incompatibility with Automatic Tire Inflation Systems

Automatic tire inflation systems will return nitrogen levels to a normal concentration