Lightweighting

Emissions regulations combined with fuel economy features and driver amenities on today’s commercial vehicles have added 1,000 lbs. to the typical Class 8 truck. Certain fleets like bulk haulers value weight savings more than other segments of the market.

To understand the true benefits of reducing vehicle weight, fleets should look beyond fuel economy improvement to freight efficiency gains—the ability to use fewer trucks to carry the same amount of payload. Fleets can save 2,000 lbs. by investing to a limited degree in lightweighting and as much as 4,000 lbs. with an aggressive investment. Lightweighting can take place in various areas of the tractor and trailer including the powertrain, axle suspensions, wheel ends, drive shaft, frame, 5th wheel, and more.

Benefits

Fuel Savings

0.5% to 0.6% for every 1000 lbs. of weight reduction

Increased Freight Efficiency

Every pound of weight taken off the truck translates to another pound of payload that that the truck can legally carry

Driver Retention

Lighweighting makes it possible to spec driver amenities that add weight

Additional Fuel Efficiency Technology

Lighweighting makes it possible to spec other fuel efficiency technologies like aerodynamic devices and idle reduction products

Regulatory Compliance

A variety of regulations impact vehicle weight, lightweighing helps fleets comply with those regulations.

Sustainability

Lightweighting can reduce the number of trucks needed to haul the same amount of freight which is a major sustainability gain.

Challenges

Upfront Costs

The upfront cost to save 4,000 lbs. of weight does not offer an attractive payback, unless the duty cycle is payload limited.

Negative Impacts On Resale Value

Things like 13-liter engines, short and/or flat topped sleepers, 6×2 axles, other de-contenting, and less fuel tank capacity result in a lower resale value

Higher Maintenance Costs

Components may not be as robust and may be damaged more easily

Ability to Take Advantage

It is difficult to determine how much additional revenue and/or lower operating costs will be guaranteed

Redundant Product Testing

Time to market for lightweighting features is long in part because of redundancies in product testing.

Common Fleet Strategies

Only bulk carriers—representing 2% of the industry—operate at the 80,000 lb. limit nearly all the time. These fleets are willing to pay $6 to $11 up front cost per pound of weight saved. The majority of bulk haulers have already invested in lightweight technologies. About 10% of the trucks on the road—primarily reefers and some dry vans with dedicated routes—gross out on 10% of their trips. These fleets are willing to pay $2 to $5 per pound of weight saved. The other 88% of the trucking industry are dry van units that rarely travel (only 2% of the time) at maximum weight. These fleets are willing to pay $0 to $2 per pound of weight saved.

What People Are Saying

“The benefits of lightweighting are centered on payload — to carry more freight, or to offset the weight of other features added to the tractor and trailer.”

– Andrew Halonen, NACFE Lightweighting Consultant

“Lightweighting makes sense in a wide variety of applications when it is looked at not only in terms of better fuel economy but also improved freight efficiency.”

– Mike Roeth, NAFCE Executive Director

“If you’re not careful, the weight of these newer trucks will get away from you. In this industry, weight costs. Being able to shave off 2,000 lbs. on the base tractor equals profit — plain and simple.”

– Jamie Hagen, Owner and Truck Driver, Hell Bent Xpress LLC

Decision-Making Tools

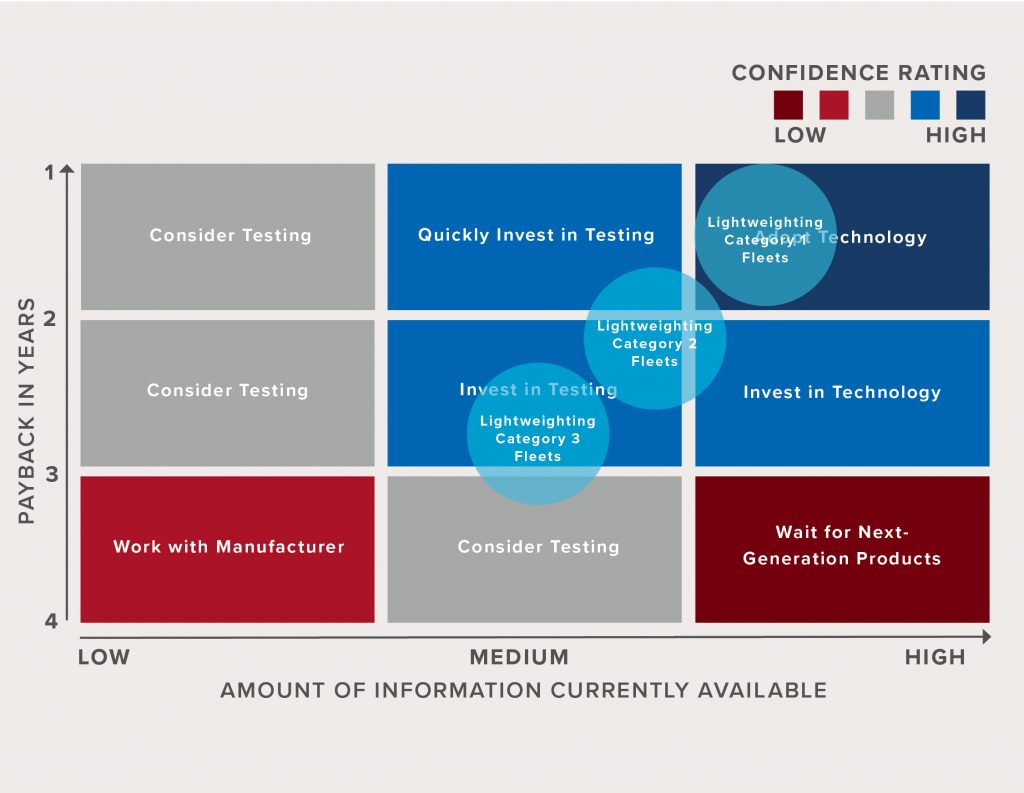

NACFE developed a tool to assist fleets in evaluating lightweighting. The Confidence Matrix shows how confident NACFE is in the adoption case for lightweighting.

Conclusions

- Through surveys conducted for this Confidence Report, the trucking industry confirmed the following trends:

- Tractor and to some degree trailer weights have increased,

- Freight is becoming denser, and

- Shippers are loading more pallets per trailer.

- Currently, the market can be divided into three categories with respect to its weight sensitivity and the percent of time that fleets are requested to gross out.

- Category 1: Trucks that currently travel at the 80,000-lbs. limit at some point along nearly 100% of their routes. This represents a small percentage of the industry (about 2%). This segment consists of bulk carriers.

- Category 2: Trucks that are loaded to the maximum weight (gross out) on a minority, perhaps 10%, of their trips. This represents about 10% of the trucks on the road, mostly refrigerator units but also some dry van routes.

- Category 3: Dry van units that rarely (2% of the time) or never travel at maximum weight, either because they are filled to maximum volume (cube out) before they gross out, or simply because their routes and cargo patterns are not conducive to traveling full. About 88% of the trucking industry falls into this category.

- NACFE finds that over the next five to 10 years and in light of these trends, shippers will request that Category 2 and Category 3 trucks double the percent of time they gross out, to 20% of the time for Category 2 and 4% of the time for Category 3.

- In order to meet these trends head-on and accommodate the heavier, denser freight, Category 2 and 3 fleets will have two options — add more trucks to the road, or explore lightweighting so that at least some of their trucks will be able to carry more freight.

- Lightweighting is by far the better option. Along with improving the overall freight efficiency of a fleet, lightweighting is a good investment because it opens the door for the adoption of additional beneficial technologies that might otherwise make a truck unacceptably heavier than it currently is.

- Both steel and aluminum wheels have dropped 5 lbs. each since the original study.

Recommendations

The study team developed the following recommendations:

- Above all, this report recommends that Category 2 and even Category 3 fleets begin to explore and spec lightweighting technologies in order to improve freight efficiency in the face of current industry trend. By doing so, they may even produce economies of scale that bring down the upfront cost of these technologies, while perhaps opening up new options for Category 1 fleets to adopt technologies that are currently too expensive.

- Another recommendation to bring down costs is for the industry to collaborate in order to address current redundancy in the development, testing, and product availability cycle among product developers, tractor-trailer integrators, and fleets.

- Finally, lightweighting for freight efficiency is a critical component of fuel efficiency, as it will facilitate the adoption of additional fuel efficiency technologies. Fleets should spec lightweighting options together with their other efficiency choices.