More Regional Haul

If you ask most people to define trucking, words like “over the road” and “long haul” are likely to be part of the description. But the reality is that 45% of the Class 8 tractors produced today are day cabs, and a high percentage of those trucks are involved in regional haul operations.

Both outside influences and changes in the trucking industry itself are having an impact on length of haul and the way freight gets delivered. This study looked at the potential of a significant increase to a known but often under recognized segment of the market — Regional Haul.

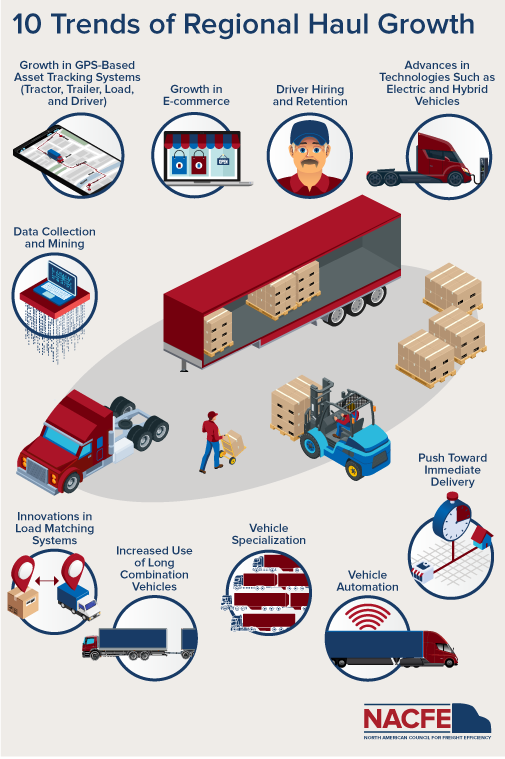

This report focuses on assessing the current state and future of regional haul as a result of trends in driver retention, growth in e-commerce, the push toward immediate delivery, growth in GPS-based asset tracking systems, advances in technologies such as electric and hybrid vehicles, vehicle automation, and innovations in load matching systems.

Methodologies and Scope

NACFE’s research for this report included interviewing key people with first-hand knowledge of regional operations at fleets, manufacturers, and industry groups. The report includes an extensive list of references to assist readers interested in pursuing more detail. These references were researched with the same diligence and thoughtful processes NACFE uses with its technology Confidence and other Guidance Reports.

This report covers regional haul in Classes 7 and 8 tractor-trailer operations that use vehicles (day cabs or sleepers) with gross vehicle weight ratings (GVWR) greater than 26,000 lbs. Although NACFE recognizes that regional can include a wide range of trailer types such as containers, fuel tankers, grain haulers, milk tankers, chemical tankers, bulk haulers, car haulers, and more, we limit this report to dry vans and refrigerated van trailers in any of a number of configurations as the majority volume is in this segment.

Conclusions and Recommendations

NACFE confirms that there is a growth in regional haul operations versus over the road (OTR) operations driven by a combination of several factors:

- Driver hiring and retention

- Growth in e-commerce

- The push towards immediate delivery

- Growth in GPS based asset tracking systems (tractor, trailer, load and driver)

- Advances in technologies such as electric and hybrid vehicles

- Vehicle automation

- Innovations in load matching systems

- Increased use of long combination vehicles

- Data collection and mining

- Vehicle specialization

The two biggest takeaways from the report revolve around drivers and alternate fueled vehicles. Regional operations means drivers are more likely to get home on a regular basis and that could help the industry with its driver recruitment and retention problem.

Regional operations are also fertile ground for alternate fueled vehicles because by their very nature they make it easier for fueling infrastructure for vehicles that use an energy source other than gasoline or diesel fuel to be installed.

Decision-Making Tools

Regional freight is a proving ground for new technologies, new operational models and business practices. There are a number of trends interacting to define the future of Regional freight hauling. Those trends are:

- Driver hiring and retention

- Growth in e-commerce

- The push towards immediate delivery

- Growth in GPS based asset tracking systems (tractor, trailer, load and driver)

- Advances in technologies such as electric and hybrid vehicles

- Vehicle automation

- Innovations in load matching systems

- Increased use of long combination vehicles

- Data collect and mining

- Vehicle specialization