The Case for MD Box Trucks

The Run on Less – Electric demonstration focused on the medium-duty box truck segment of the trucking industry, in addition to terminal tractors, vans and step vans and heavy-duty regional haul tractors.

The three fleet-OEM pairs in the medium-duty box truck market segment were:

- Day & Ross with a Class 6 Lion6

- Frito-Lay with a Class 6 Peterbilt-Cummins 220EV

- Roush Fenway Racing with a Class 6 ROUSH CleanTech Ford F-650

How It Worked

This report’s conclusions were generated through the data collection and calculations from the three medium-duty box trucks that participated in Run on Less – Electric, interviews conducted with representatives from the participating fleets and tractor builders and input from other industry experts.

All three vehicles were instrumented with a Geotab telematics device that tracked daily range, speed profiles, state of charge, charging events, amount of regenerative braking energy recovery, weather and number of deliveries.

Findings

The study team has five key findings based on the three battery electric medium-duty box trucks that participated in RoL-E.

- Medium-duty box trucks are a great application for electric trucks given their short distances and return-to-base operations. The vast majority of medium-duty box trucks are not driven long distances and are home every night. They are an ideal portion of the overall medium-duty truck market for electrification. Other medium-duty applications that do not require much battery power to operate aspects of the body also can be good candidates for electrification.

- Medium-duty trucks almost always have a second manufacturer who adds body devices requiring engineering design and validation as well as manufacturing planning for electrification. Truck equipment manufacturers (TEMs), also known as body builders, will be adding a wide variety of bodies to medium-duty chassis. While a simple van body doesn’t require a lot of additional engineering or validation, many other applications will be much more challenging in terms of installation, operations, safeguards and more.

- More complex Class 6 and 7 trucks such as snowplows, refuse trucks, and fire trucks will require significant efforts which will delay electrification timing. Trucks that see continuous operations for a day or more such as a snowplow or utility truck, will be obvious challenges for battery electric powertrains. This isn’t to say that some prototypes will be developed and shown, but they are less likely to be seen in significant volumes in the near future.

- Application expansion into more complex medium-duty trucks will occur as knowledge is gained. Tackling relatively simple and straightforward applications such as box trucks provides the trucking industry with a launching point to design, build, validate and refine battery electric trucks. The industry will learn things such as how much of the battery is consumed by various cab air conditioning and heating demands. It also will learn about how lift gates and other peripheral devices tax power consumption. This knowledge can be carried over to more difficult applications, providing a “known step” as the industry works through the issues in other more complex applications.

- Other aspects such as driver attraction and retention benefits, maintenance savings and infrastructure challenges exist as they have for other market segment use cases. Battery electric trucks will offer both benefits and challenges. Finding grants and incentives to make the vehicles more affordable is not easy and available funds disappear quickly when they become available. Charging infrastructure presents an entirely new set of challenges for fleets from parking lot planning, to building permits, inspection approvals and operations. What has been very positive is the response of the drivers that have driven these electric trucks. The vehicles offer many positive attributes that drivers find attractive at a time when drivers are hard to both find and keep; these differences can be valuable.

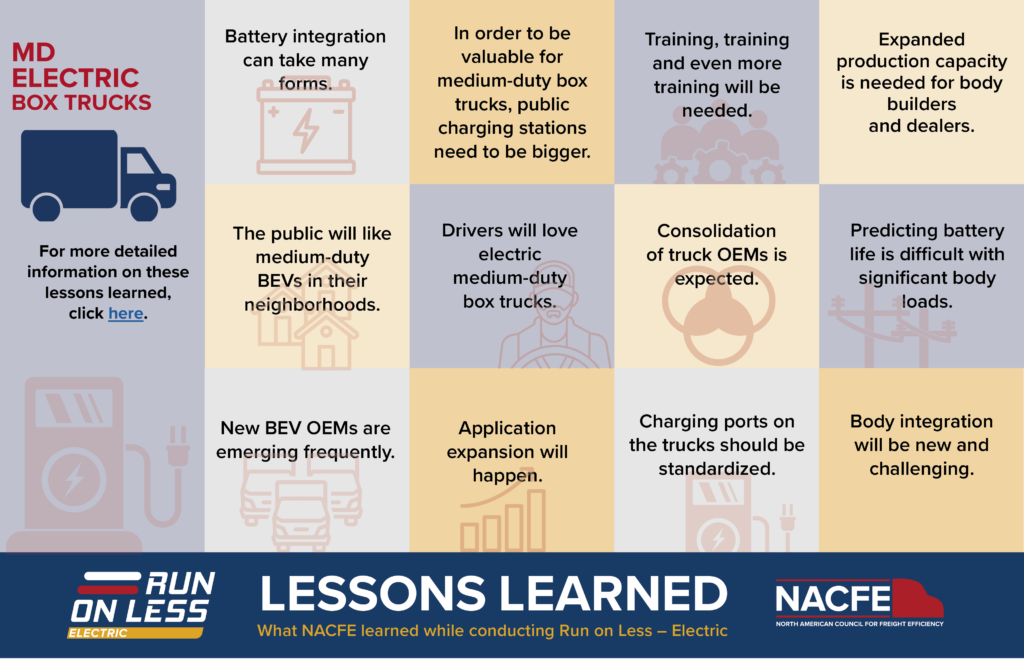

Lessons Learned

NACFE learned a number of lessons during the three weeks of the Run specific to medium-duty box trucks.

Conclusions

NACFE believes that 100% of the medium-duty box truck market segment will embrace electrification although some applications within the duty cycle will be easier to electrify than others that have more complex bodies.

When the simpler box truck portion of this market segment, about 380,000 trucks in the US and Canada, electrifies, it will result in the avoidance of 7,681,707 metric tonnes (MT) of CO2e annually. The more complex trucks in this category will also electrify as the medium-duty marketplace expands the electric coverage over the next decade. These trucks cover both freight and work truck use cases.